When Skills Become Financial Instruments The Dangerous Transformation of Human Capability

For centuries, a skill was simple. You learned something. You practiced it. You became useful to others. The exchange was direct: capability for wage. That model was imperfect, but it was human and understandable.

Now a new idea is emerging in the AI economy: treating skills not as attributes of people, but as tradable assets. Micro-credentials, verified competencies, reputation scores, and blockchain-anchored achievements are increasingly packaged into standardized units. Investors and platforms dream of converting them into something that looks suspiciously like securities.

The logic sounds attractive. If a skill can be verified, measured, and proven, why shouldn’t it generate predictable cash flows? Why shouldn’t a “Top 5% Python Developer Certificate” be priced like a bond? Why shouldn’t a portfolio of engineering skills be evaluated like equity in a startup?

Because the moment you do that, you stop talking about education and start talking about markets — and markets are brutal machines that consume whatever they can quantify.

Step 1: Standardization

Financial instruments require comparability. A bond works because one bond is like another. A stock has value because shares are identical units.

To turn skills into instruments, the first requirement is painful standardization. Diverse human learning paths must be flattened into rigid taxonomies. Nuance is erased. Context is ignored. The messy process of becoming competent is reduced to digital badges and percentages.

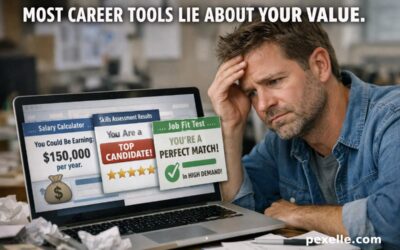

Platforms that push this agenda pretend that the map is the territory. They design skill graphs and scoring systems like the ones you’re building with Pexelle and assume that verified data equals verified value.

It does not.

A credential only says something about past performance. Finance demands promises about the future.

Step 2: Tokenization

Once standardized, skills are tokenized. The dream is to create digital tokens representing competencies. These tokens could be used as collateral, staked for project access, or even sold to backers who expect a return when the skilled individual earns income.

This is where the idea crosses from innovative into ethically questionable.

You cannot separate a skill from the person who holds it. Unlike real assets, skills decay, change, and depend on motivation, health, opportunity, and environment. A token cannot force someone to remain excellent. But a market built on those tokens will still demand yield.

So risk is quietly transferred from investors to humans.

Step 3: Financialization

The final stage is full financialization. Hedge funds, recruitment marketplaces, and AI-driven workforce platforms begin pricing people based on instrument-like bundles of skills.

Hiring decisions become algorithmic bets. Instead of asking “Can this person help us?” companies ask “What is the expected ROI of this skill package?”

This shift feels modern and efficient. In truth it is a philosophical betrayal.

It reframes human growth as a revenue stream owned by platforms. It encourages speculation on individuals’ careers. It pushes young professionals to chase whatever credentials are most “liquid” instead of whatever is most meaningful.

Education becomes mining. Humans become ETFs.

The Hidden Risks

- Moral Hazard – If third parties profit from your future earnings, your autonomy is compromised.

- Mispricing – Markets will inevitably overvalue fashionable skills and undervalue critical but unsexy ones like agriculture, caregiving, or craftsmanship.

- Inequality Amplification – Those who can afford certification fees manufacture instruments; the rest are invisible.

- Regulatory Nightmares – When platforms promise returns on skill tokens, they invite securities law intervention they are not prepared for.

- Human Pressure – Failure is no longer personal; it becomes a financial default.

A More Honest Model

Skills should absolutely be verified. Data about capability is powerful. But the correct use of that power is better matching, better training, and clearer trust between employer and worker not speculation.

A recruitment marketplace can use immutable records to reduce fraud without turning credentials into securities. A platform can help people display proven competencies like you plan while respecting that the economic unit is still the human being, not the badge.

Financial markets are useful servants and terrible masters. Let them price companies, projects, and commodities. Do not let them price souls.

Conclusion

The idea of converting skills into financial instruments is not the future of work. It is the Wall Street version of the future a future that looks neat in spreadsheets and ugly in real life.

True innovation lies in enabling a trustless verification economy, not a trustless speculation economy.

If you build systems like Pexelle, build them as bridges between people and opportunity. The moment you try to turn them into investment vehicles, you’re no longer innovating you’re just inventing new ways to exploit measurement.

And that is not progress.

Source : Medium.com